All listed companies in Australia must prepare and present a Remuneration Report to shareholders at each Annual General Meeting (AGM). This Remuneration Report involves specific information to be provided by listed companies as part of the Director’s Report.

Statutory Considerations of Remuneration Reports

Rem Report Inclusions

As per section 300A of the Corporations Act (2001), the Remuneration Report should include:

- The board’s policy for determining the nature and amount of remuneration of the key management personnel (KMP)

- The relationship between such policy and the company’s performance

- Explanations of relevant performance hurdles

- Outline the actual remuneration paid to KMP

Key Management Personnel (KMP)

Your Key Management Personnel are anyone who has authority and responsibility for planning, directing and controlling the activities of the organisation, directly or indirectly.

This definition includes at least all directors at an organisation and in many cases other senior executives with significant responsibilities.

As this definition is a qualitative measure, judgement will at times be required who best fits this definition.

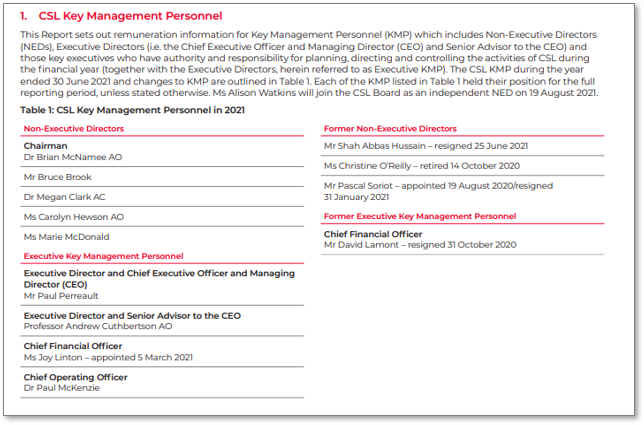

The example to the right (taken from CSL’s 2021 Remuneration Report) highlights one effective way to disclose Key Management Personnel.

The report sets out clearly the definition of KMP that has been used in the introductory paragraph and then separates the various KMP into a number of clear categories, making the information very easy to digest and understand.

Disclosing Details of Your KMP

Whilst there is no mandated format for disclosing you Key Management Personnel, there are a number of specific details that must be disclosed in different situations depending on the following factors.

At a minimum, you must disclose the name and the title of the position held by all KMP.

As well as this, there are a number of conditions set out in the Act which dictate when other details must also be disclosed.

If the KMP has held a position for less than the whole financial year, you must disclose:

- a) The date on which the person began holding the position

- b) The date (if any) on which the person ceased to hold the position

If there has been a change in CEO or a director during the period either starting immediately after the reporting date; and ending immediately before the date on which the financial report is authorised for issue, you must disclose:

- a) The name of each person involved in the change

- b) The position involved

- c) The date on which the change occurred

If a person (other than a director or CEO) has retired during the period starting immediately after the reporting date; and ending immediately before the date on which the financial report is authorised for issue, you must disclose:

- a) The person’s name

- b) The position involved

- c) The date on which the retirement took effect

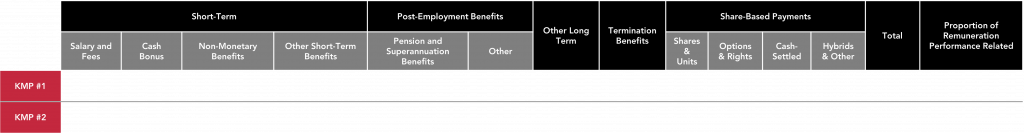

What Remuneration Elements Must be Disclosed?

The following payments and benefits should be disclosed as part of the statutory remuneration table:

The person’s short-term employee benefits, divided into at least the following components:

- (a) cash salary, fees and short-term compensated absences;

- (b) short-term cash profit-sharing and other bonuses;

- (c) non-monetary benefits;

- (d) other short-term employee benefits

The person’s post-employment benefits divided into at least:

- (a) pension and superannuation benefits;

- (b) other post-employment benefits

The person’s long-term employee benefits (other than those already mentioned), separately identifying any amount attributable to a long-term incentive plan

Payments (if any) made to the person, before the person started to hold the position, as part of the consideration for the person agreeing to hold the position, including:

- (a) the monetary value of the payment; and

- (b) the date of the payment

Share-based payments made to the person, divided into at least the following components:

- (a) equity-settled share-based payment transactions, showing separately:

Example Statutory Remuneration Table