Effective and appropriate benchmarking can provide a quantitative input for decision making and also offers a rearview mirror – how well did we meet our targeted outcomes?

However, benchmarking is never conclusive in its own right. It doesn’t tell us whether arrangements are appropriate or not (though it may help understand potential effectiveness) as we need to consider those situation-specific factors mentioned above.

Essentially, we need to contextualise the numbers in order to decide where we need to pitch remuneration and, when looking at past outcomes, whttp://www.mastertek.com.auhether our programs have been effective. Traditional approaches have tended to focus on the relative positioning of remuneration, but ignore the performance aspect.

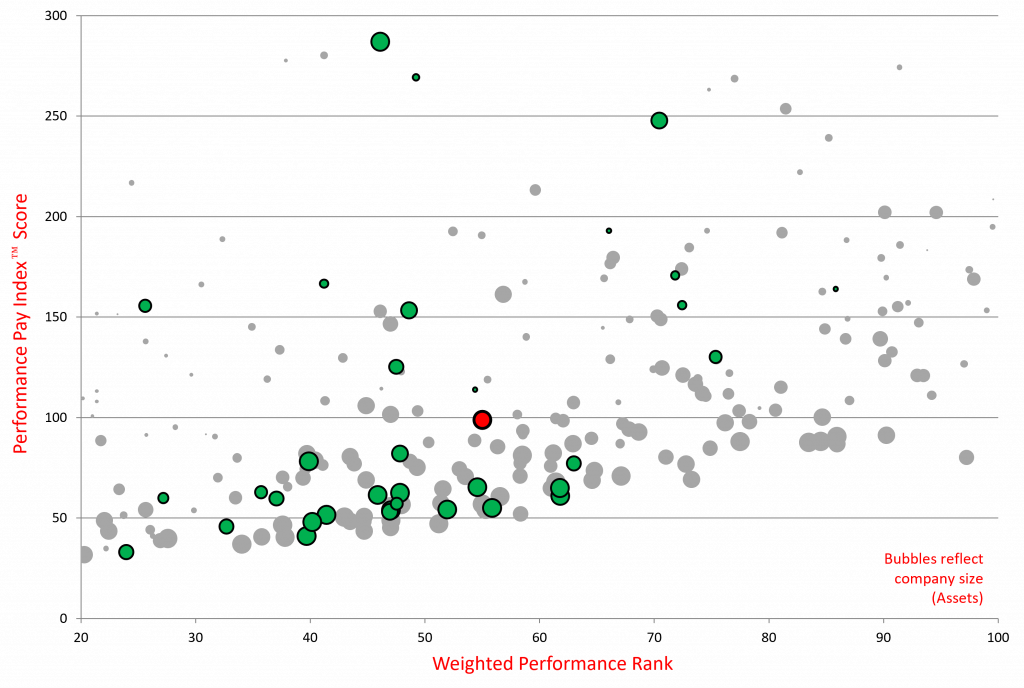

Given one of our principles is to reward performance we need to adopt a different approach such as referencing our Performance Pay Index which offers some great insights into the correlation between pay mix and company performance.