Leading the design and management of a long term incentive plan can be one of the most challenging, and complex, tasks facing remuneration and reward professionals. We’ve highlighted below some of the key considerations from a long term incentive design perspective, considering how your plans fit in as part of a broader executive remuneration strategy, as well as outlining the more common types of LTI plans and the pros and cons of each.

Long Term Incentives and Equity Plans

Start With Strategy

In designing reward programs we first seek to ensure alignment with the organisation’s corporate strategy, culture and values.

Potential components of the total reward opportunity can be categorised according to the potential of each item to contribute to business results. At one end of the spectrum, base salary and benefits costs of doing business because these are expenses necessary to attract individuals to the organisation but are difficult to attribute to improvement in business results.

At the other end of the continuum, performance-based rewards such as profit share and long term incentive plans only provide rewards when the performance outcomes are measurable and of value to the organisation.

Similarly, we may also find there is a delineation between individual and group aspects of reward. Reward components that can be used to reinforce the achievement of group (e.g. business unit or organisation-wide) objectives include short and long-term incentives. Group based plans are expressly designed to improve organisational performance as they reward employees for collectively knowing, understanding, focusing and acting on the objectives that will achieve success for the organisation.

For a greater insight to the best practice reward strategy click below for further reading.

Instrument Types

With a clear strategic role for your long term incentive plan in mind it is time to evaluate the different delivery ‘instruments’ that to determine which will be most effective in your context.

The first decision is whether the plan will be equity-based in nature. Long term incentives are normally paid as equity, particularly for publicly listed companies and are usually designed to create alignment between the executive’s actions and the interests of the company and its shareholders. In principle equity plans help to deliver this alignment by basing reward on the business value created over a period of time.

Alternatively, cash-based plans tend to be used by companies who are “cash-rich & equity poor”, have little or no equity for distribution, or where there is a lack of appetite for dilution. The key consideration here is the potential impact on the organisation’s cash flow when incentive payments become due.

Share Options and Performance Rights

- A right, usually granted to an employee, to purchase or acquire a share in the company in the future, for example 3-5 years

- Vesting is tied to the achievement of performance criteria

- Such instruments are used by companies who have moderate-high stock price growth projections, who may wish to transition ownership through succession and mitigate capital funding

- Rights are considered to be more appropriate than options for mature, stable companies where year on year growth is unlikely

Restricted Stock

- Rights granted to an employee to acquire a share in the company at Nil exercise price. The shares vest after a pre-determined period of time. Performance hurdles may also apply

- Staged vesting may apply, with vesting typically tied to tenure over 3 to 5 years

- Often used by mature and stable organisations who have moderate stock price projections and measure performance in other ways (e.g. EBIT, EPS, NPAT)

- Also used where retention of key staff is a key objective of the plan, where no performance criteria are attached to vesting (making vesting purely time based

Share Appreciation Rights

- Also known as Phantom plans when the benefit is delivered in cash

- A right granted to an employee, to receive a cash sum equal to the increase in value of underlying shares between the date of exercise and the date of grant

- Performance conditions typically apply

- Typically settled in cash, but may be settled in shares at Board discretion

- Used as a way of offering a long-term incentive that is linked to the value of the business without providing true equity

Cash Incentives

- Involve a cash-only incentive opportunity and payment

- Removes the need for a formal valuation of the company

- Control over potential benefit values sits with the company

Can be a best-fit option in companies where governance over incentive outcomes is of key consideration

For a more detailed review of the different types of long term incentive instruments, you should consider and the pros and cons of the different approaches click below to download our LTI types summary sheet.

Instrument Valuation

Listed companies are required to estimate the value of long-term incentives when they are granted for the purpose of publication in the Annual Report although this value is subject to the fluctuations of financial markets and business performance over a longer period.

It’s important to be aware that the accounting value may be very different to the market value of shares used for tax purposes and different again from the realised benefit value to the participant when the incentives vest.

Grant Frequency

Some of the key design questions to explore when considering the frequency of grants to be made under your long term incentive plan include;

- Does the company intend to make annual LTI grants/offers? This decision is likely to be largely influenced by the structure and mix of the broader reward offering

- Consider whether a grant of shares in respect of past performance/contribution is warranted, or has this performance already been rewarded using other reward levers?

Keep in mind that the 3-5 year time frame for measuring performance and vesting of long term incentives means that there is not likely to be any benefit for the employee for some time – how might you use other forms of reward to help incentivise during this initial period?

Grant Values and Opportunities

With a clear strategic role for your long term incentive plan in mind it is time to evaluate the different delivery ‘instruments’ that to determine which will be most effective in your context.

The first decision is whether the plan will be equity-based in nature. Long term incentives are normally paid as equity, particularly for publicly listed companies and are usually designed to create alignment between the executive’s actions and the interests of the company and its shareholders. In principle equity plans help to deliver this alignment by basing reward on the business value created over a period of time.

Alternatively, cash-based plans tend to be used by companies who are “cash-rich & equity poor”, have little or no equity for distribution, or where there is a lack of appetite for dilution. The key consideration here is the potential impact on the organisation’s cash flow when incentive payments become due.

Percentage of Salary

Setting LTI grant levels based on the participant’s fixed remuneration levels is one of the most common approaches.

- Typically varies accordng to the extent to which each participant is able to influence the long-term results of the company

- Typically organisations will conduct benchmarking against peer companies to determine competitive levels for incentives within the context of the organisations own internal remuneration philosophy

Role, Performance and Potential

Some of the individual performance factors which may be taken into account include:

- Level and nature of the participant’s role in the business

- Potential for the individual to contribute to group performance

- Past performance of the individual (could determine the size of individual grant)

- Tenure and loyalty to the organisation

- Potential risk and impact of the person leaving the business

Group or Team Performance

Here are some of the company-based performance factors which may be taken into account:

- Past performance of the company

- Anticipated company performance

- Care should be taken to consider the market reaction to large grants where company performance has not met expectations

- Grants based on past Group performance may mean that Grant values are at their lowest when the business most needs to motivate and incentivise key talent

Vesting Periods and Performance Measures

Consider what period is sufficiently long-term to promote appropriate alignment with shareholder perspective? Australian Shareholders’ Association do not support schemes that have vesting/performance periods of less than three years. Is three years considered long-term? Is it too short?

Consider whether a proportion of the grant vests on various dates, versus all at once (‘cliff’) based on cumulative performance. Consider tax implications for participants – click here to read more on Long Term Incentive Taxation Considerations. Consider whether there will be more than one opportunity to test performance against pre-defined criteria or a single test.

- Relative Performance; Performance hurdles are routinely applied to option grants and other LTI plans in Australia and Relative Total Shareholder Return is the most commonly used long-term hurdle (for equity plans). Consider availability of relative performance metrics. Performance relative to a peer group of organisations is favoured by shareholder groups who consider the success of investments in relation to the performance of alternative investment opportunities. By contrast, however, executives may feel that the relative performance is not in their control and that results may be impacted by any number of external factors not linked to their performance

- Absolute Performance; Companies use a range of measures, such as accounting measures of financial performance, measures linked to the company’s share price, and other strategic measures that may not be publicly disclosed and reflect an agreed objective (or objectives) that the company sets for its own performance

- Individual Performance; An example could be the Head of a Business Unit, where individual performance measures relate to the performance of that Business Unit

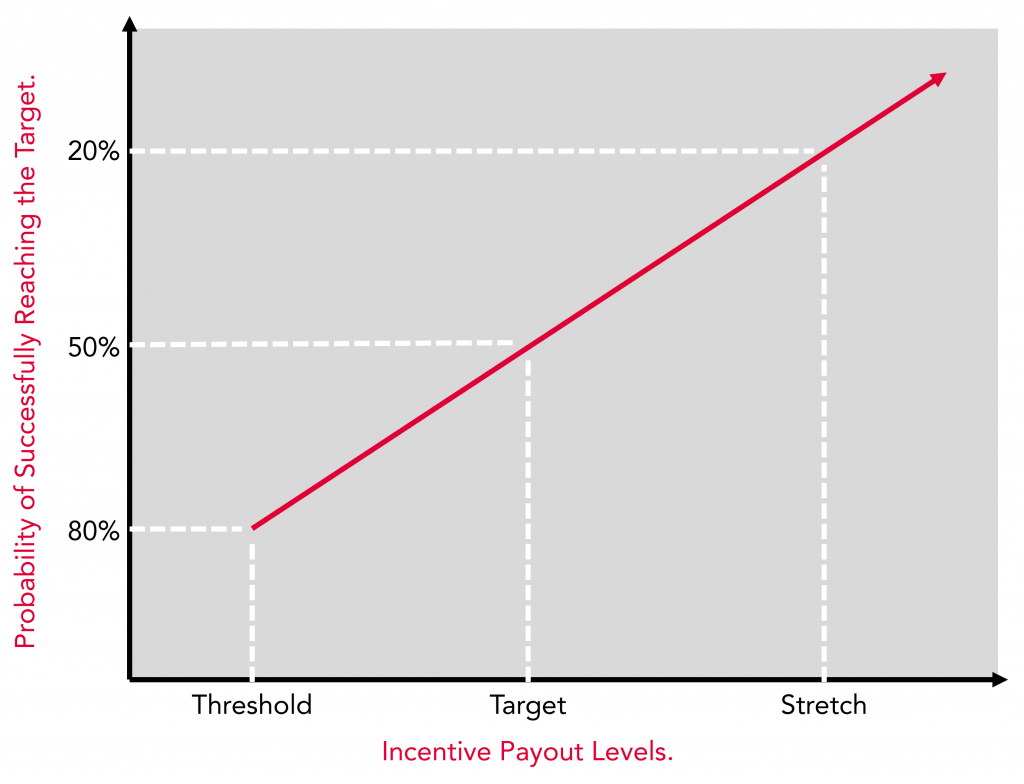

Care should be taken to ensure the measures are effective and appropriate; that they do not excessively reward mediocre performance; that the performance levels are not “too soft”. The ASA position is that LTI plans “should be designed to reward superior (not just average) performance”. How would you define average and superior performance? We recommend considering the ‘Probability of Success’ model to help stakeholders establish measures that effectively drive performance.

Settling Vested Long Term Incentives

- New issue; New issues of stock to satisfy vested equity grants have the benefit of minimising the cash expense required to satisfy the incentive plan

- Purchase on market; Purchasing shares on market provides an alternative to dilution, it does require cash investment in the plan. Consider a long term share purchase strategy to minimise the cost exposure of on-market purchases (e.g. purchasing all stock at vesting may mean the company pays more for the stock than if shares were purchased earlier in the vesting period)

- Accrual of cash; In the case of cash-based incentive systems, it is typical for companies to budget for a considered proportion of the total incentive amount on offer (typically 100%) and subsequently adjust the accrued amount at regular intervals (e.g. quarterly) depending on likely payout estimates

Exercise and Disposal Restrictions

- Holding Period; Companies often enforce a ‘holding period’ before which vested shares can be traded to ensure participants retain the interests beyond the period over which performance was measured for vesting purposes

- Hedging; The purpose of the equity-based incentive plans is to make part of executives’ remuneration subject to the risks and benefits of fluctuations in the share price, in order to align the financial interests of executives with those of shareholders. This purpose is defeated if participants are permitted to hedge the price risk on the shares or rights they receive under an employee share scheme

- Sale or Trading of Shares; It is important that the sale or trading of shares is also managed so as to comply with the ASX share trading rules, particularly regarding insider trading. The company’s own share trading policy should be considered, with a view to aligning vesting periods with scheduled trading windows wherever possible

- Deferral/Staggered Payments; In respect of cash-based plans any incentive benefit that becomes due may be paid out in staggered instalments to assist with both staff retention and to help ‘smooth’ payments related to LTI over a period of years (particularly useful where it is envisaged that the plan may not pay out in full, or at all, each year)

Admin and Plan Management

- Grant Proposals; Who will be responsible for preparing and collating LTI grant/offer proposals each year?

- Shareholding Restructure; Particularly relevant to organisations at the start-up end of the business lifecycle is to consider the impact on LTI plans of corporate restructuring. Will LTI grants be ‘mirrored’ in any new entity for example

- Plan Administrator; Does the company have a preferred plan administrator in mind? Mastertek can facilitate introductions to key service providers as required

- Internal Administration; Consideration must be made regarding internal administration/management of the program, typically resulting in the nomination of an administration individual who will be involved in such things as performance testing, determination and/or recording of grants, individual participation and incentive opportunities